What Is One Key Advantage to an Employer-sponsored Retirement Plan

Employer contributions to these types of plans are tax-deductible on your year-end. One reason is that your pretax contributions to your employers plan lower your taxable income for the.

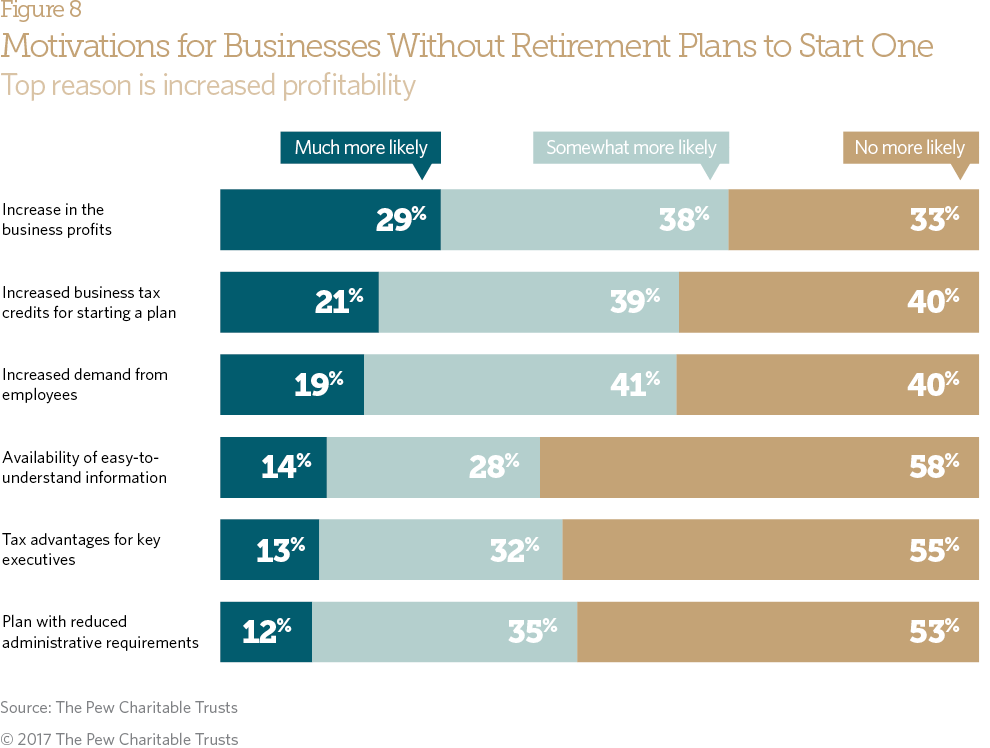

Employer Barriers To And Motivations For Offering Retirement Benefits The Pew Charitable Trusts

An employer-sponsored retirement plan is a workplace benefit offered by some companies to help provide workers with income in retirement.

. Ad Help Employees Get More Out of Retirement. A 401 k plan is a tax-advantaged retirement plan. One major difference between a personal IRA and an ESRP is the contribution limit.

Taking Advantage of Employer-Sponsored Retirement Plans. Ad Experienced Support Exceptional Value Award-Winning Education. Defined benefit plan pension plan that pays a retirement benefit spelled out in the plan and you are eligible to participate for the plan year ending with or within the tax year.

Are you taking full advantage of your employers retirement plan. A defined contribution plan. One reason is that your pre-tax contributions to your employers plan lower your taxable.

Discover Why Choosing Schwab Retirement Plan Services Means Experience Personal Service. Get Help Designing Your Plan. You should always take advantage of the employer match since it will give you a 100 return on your matched contributions by the time you are ready for retirement.

Employers sponsor defined benefit plans and typically hire investment managers to make investment choices. For an IRA you can contribute up to 6000 per year if you are under the age of 50 or 7000 per year if you. Why put your retirement dollars in your employers plan instead of somewhere else.

Ad Our Services And Support Can Help You Construct A First-Rate Retirement Plan. As a result here is what you may. Why put retirement dollars in an employers plan instead of somewhere else.

A recent survey by TIAA-CREF revealed some startling data. Employer-sponsored retirement savings plans are useful for both employees and employers as they present benefits like savings directly deducted from your paycheck tax. Ensure that employers contribute the minimum amount of money necessary to provide employees and beneficiaries with promised benefits.

One of the biggest advantages these types of plans have to offer employers is in the form of tax breaks. Over one-third of those surveyed either did not know what an IRA is or the difference between an IRA and an employer. While employer-sponsored IRAs are not very well known even to many tax pros and CPAs they offer some unique advantages from other employer retirement plans.

One reason is that pretax contributions to an employers plan lower taxable income for the year. The cost for health care is a liability for most employers and they want to limit that liability by transferring the current retiree plans to the retiree. The employer shoulders the investment risks.

By contributing you can lower. Why put your retirement dollars in your employers plan instead of somewhere else. Our Team of Rollover Specialists Make it Easier to Roll Over Your 401k into an IRA.

We Focus On Plan Features That Can Drive Outcomes For You And Your Employees. Here are just some of the ways to make the most of your benefits. With a 401 k your money can grow tax-free.

Most people open up 401 k plans through their employers. Employer-sponsored qualified retirement plans such as 401 ks are some of the most powerful retirement savings tools.

Are You Looking For The Perfect Money Books For Real Inspiration Whether You Re Looking To Save Money Mak Rich Dad Poor Dad Rich Dad Poor Dad Review Rich Dad

Roth Ira Vs Traditional Ira Know The Difference Budgeting Finance Investing Finance

Employer Barriers To And Motivations For Offering Retirement Benefits The Pew Charitable Trusts

Coordinating Contributions Across Multiple Defined Contribution Plans

0 Response to "What Is One Key Advantage to an Employer-sponsored Retirement Plan"

Post a Comment